A Philosophy Inspired by Eminent Thought

CBAM’s methodology is logical, simple, enduring and apt for individuals.

It has been inspired by a passion for life-long learning and has evolved over decades of studying leading, eminent minds – living and historic. “Wisdom”, as applied to investing, has been defined as the “best that other people have ever figured out”. In this sense, we think successful investors can have more in common with philosophers, “lovers of wisdom”, synthesizing the soundest tried and tested principles to proficiency rather than trying to invent anything new.

We believe our cognitive framework is further enhanced by cumulative career knowledge and experience. Our dual office locations also boost the potentiality of the extensive reading, research and quiet reflection that we do on behalf of our clients.

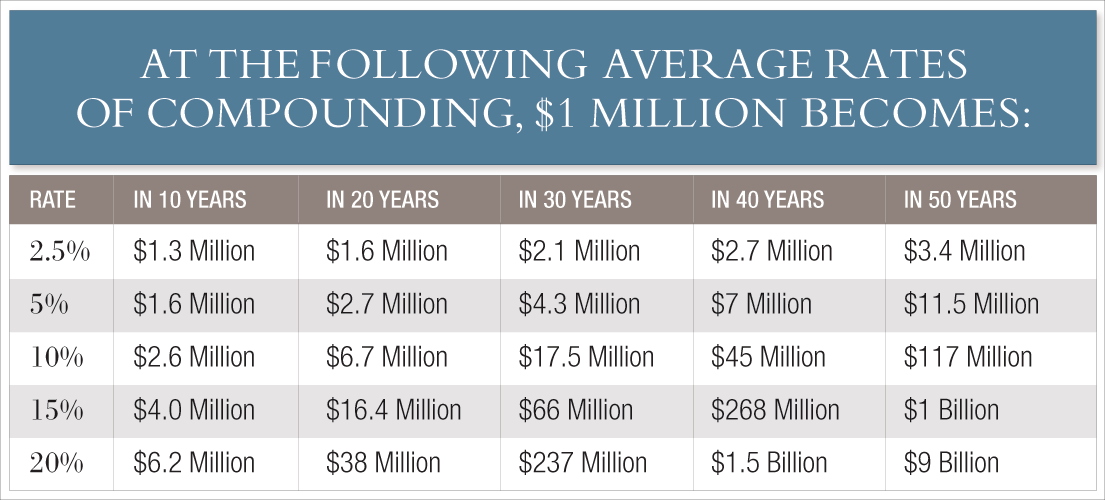

The amazing math of compounding drives our investing. It is our priority and focus. We align goals and individual investments to try to harness the effects of compound interest, aspiring with all our effort to create average, net, real, lifetime returns that are consistent with objectives and may exceed alternatives. The table below illustrates the incredible power of compounding $1 million at augmented average, annual rates for long periods:

Of course, we are not implying any particular expected return from this table. The data is being presented because, based on our experience, most investors, however sophisticated, are unaware or lose sight of this fundamental principle. We all tend to have a revelatory moment as we ponder the sheer power of compounding for long periods at different rates. We question: if investment is not, ultimately, about aspiring to improve the long term average rate of compounding to preserve purchasing power, what is it?

Our asset allocation methodology is simple and clear; we divide assets into categories that reflect real world risks and reflect personal preferences for capital stability and long term compounding.

With the goal of compounding the priority and focus of decisions, we make investment selections based on our determination of intrinsic value and other objective valuation criteria. This facilitates a businesslike allocation of assets within our client portfolios.

Our approach provides a suitable mental and emotional framework for investing rather than speculating in volatile public markets—we think like owners.